Buy used Finance & Accounting Entrance Exam books online in India

Buy Second Hand Books, Used Books Online In India

Operations management

Operations Management: Theory and Practice is the outcome of continuous testing of alternative ideas, concepts and pedagogical designs with MBA students, working executives from diverse industries, and research scholars. The basic concept of this book is to incorporate the salient features one usually finds in international textbooks, and at the same time, enrich the book with contextually relevant examples. New chapter: Sustainability is increasingly becoming important for businesses. Several of the current students will be required to play a key role in managing businesses that are also sust.

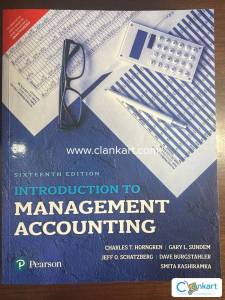

Management accounting

The Indian Financial System is a complex amalgamation of various institutions, markets, regulations and laws, analysts, transactions, claims and liabilities. This book not only thoroughly engages with these important aspects of financial system as the bedrock of the book, but also helps students, academicians and professionals to survive and thrive in today's competitive business environment. The lucid language and comprehensive approach of this book makes it invaluable both as a textbook and a reference book. This edition has been substantially revised, with incorporation of the latest amendments and changes, and important discussions on topics like financial markets and institutions, instruments, agencies and regulations in an analytical and critical manner.

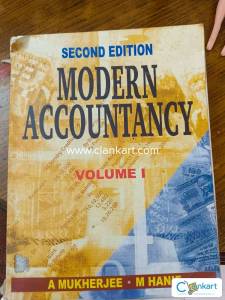

Class10 t.s. grewal's double entry book keeping

The book has been designed topic and subtopic-wise, keeping the students’ needs in mind. The current edition has certain unique features: Each chapter starts with a To Do list. It gives the central idea of the chapter and the way it has been addressed. Each chapter is divided into several sections corresponding to different components of the syllabus. Each chapter is splashed with HOTS. This is to promote clarity of the basics. Focus Zones in each chapter present a crux of the concepts. Blocks in each chapter include matter of special significance. Power Points and Revision Window offer a quick glance of the subject matter. ‘Exercise’ is tuned to the pattern of examination. Answers to important questions focus on the technique of writing. The exercise includes: objective type questions (remembering & understanding based questions), divided into five sections: (a) multiple choice questions, (b) fill in the blanks, (c) true or false, (d) matching the correct statements, (e) ‘very short answer’ objective type questions reason-based questions HOTS & applications analysis & evaluation CBSE questions (with answers or reference to the text for answers) NCERT questions (with hints to answers) miscellaneous and add-on questions (with hints or reference to the text for answers) Dos and Don’ts (at the end of each chapter) should serve as a safeguard against misinterpretation of the concepts. Ability Zone is a uniquely designed section at the end of the chapter. This raises the difficulty level, of course, but should serve as a useful material for the outstanding learners. Solved & Unsolved numericals are given to boost a grip on the subject.

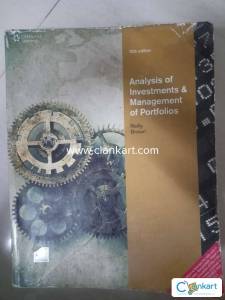

Analysis of Investment and management of portfolios

Used extensively by professionals, organizations, and schools across the country, ANALYSIS OF INVESTMENTS AND MANAGEMENT OF PORTFOLIOS, 10E, combines solid theory with practical application in order to help students learn how to manage their money so that they can maximize their earning potential. Filled with real-world illustrations and hands-on applications, this text takes a rigorous, empirical approach to teaching students about topics such as investment instruments, capital markets, behavioral finance, hedge funds, and international investing. It also emphasizes how investment practice and theory are influenced by globalization. In addition, this tenth edition includes new coverage of relevant topics such as the impact of the 2008 financial market crisis, changes in rating agencies and government agencies such as Fannie Mae and Freddie Mac, global assets risk-adjusted performance and intercorrelations, and more. Students can also take advantage of the Thomson ONE Business School Edition, an online, one-stop shop to do financial analysis and research.

Real Estate Investment-The Automatic Millionaire Homeowner- Bestseller

David Bach’s Simple System for Building Wealth Through Homeownership Will Help You Finish Rich in Any Market—Automatically Updated with a new chapter of success stories Owning a home has always been the American Dream, and in The Automatic Millionaire Homeowner, David Bach shows that buying a home and investment properties is not only possible, it is still the surest way to reach your seven-figure dreams on an ordinary income. Whether you are a renter or already own a home, Bach’s book offers a lifelong strategy for real estate based on timeless wisdom that is tried and true—in any market. He includes everything you need to know, with step-by-step instructions, including phone numbers and web sites, so you can get started right away. As long as you’re alive, you have to live somewhere. Why not let where you live make you financially secure and ultimately rich? David Bach will show you how.

The pyschology of money

Timeless lessons on wealth, greed, and happiness doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people. How to manage money, invest it, and make business decisions are typically considered to involve a lot of mathematical calculations, where data and formulae tell us exactly what to do. But in the real world, people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In the psychology of money, the author shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life’s most important matters.

The Millionaire Next Door

The bestselling The Millionaire Next Door identifies seven common traits that show up again and again among those who have accumulated wealth. Most of the truly wealthy in this country don't live in Beverly Hills or on Park Avenue-they live next door. This new edition, the first since 1998, includes a new foreword for the twenty-first century by Dr. Thomas J. Stanley.

Guide to Investing

Rich Dad's Guide to Investing is a roadmap for those who want to become successful investors and invest in the types of assets that the rich do. Whether your goal is to become financially secure, comfortable, or rich this book is your guide to understanding the asset classes and investment strategy. Robert explains his basic rules of investing, how to reduce your risk and Rich Dad's 10 Investor Controls as well as ways to convert your earned income into passive portfolio income.